Office expenses may seem small, but left unchecked, they can quietly drain your budget and conceal compliance risks. In this 2025 guide, we break down what an audit really entails, define office expenses, and offer a 10-step checklist that simplifies the process. You'll learn how to match receipts, flag red flags, and run effective reconciliations—with tips on ergonomic upgrades that support long-term employee health and performance. Real-time, automated tools now allow 100% spend visibility and faster decision-making. It's time to stop dreading audits—and start leveraging them as a competitive advantage.

In 2025, organizations can no longer afford to wait until year-end for a financial surprise 🔍. Proactive, continuous auditing of office expenses helps you:

Catch errors & fraud in real time ⚠️

Optimize spend controls month to month 📈

By following a systematic 10-step audit checklist 📋, leveraging automated tools 🤖, and weaving in smart ergonomic investments 🪑, finance teams can transform expense reviews from a dreaded chore into a strategic advantage 🎯.

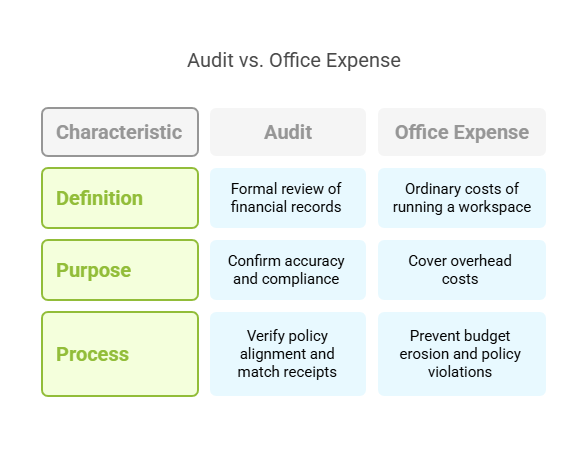

Definition of Audit

What “audit” really means

An audit is a formal, systematic review of an organization’s financial records—conducted by qualified accountants—to confirm accuracy, compliance, and transparency. This process reassures stakeholders that your expense reports reflect real costs and healthy internal controls.

What Is Office Expense

Pinpointing everyday overhead

Office expenses encompass all the “ordinary and necessary” costs of running a workspace: supplies, utilities, software subscriptions, and more. Left unchecked, these seemingly small line items can erode budgets and mask policy violations.

Auditions for the Office

Gathering your financial “cast”

Think of audit prep as casting for a production—you need every script and prop in place. Collect your expense policies, approval workflows, receipts, and system logs so you’re ready to showcase compliance and control.

How to Audit Expenses

Key steps for effective spend analysis

When I audit expenses, I always start by verifying that each cost aligns with company policy—no rogue charges slipping through—and then I match receipts to ledger entries to ensure every dollar recorded actually left your bank account.

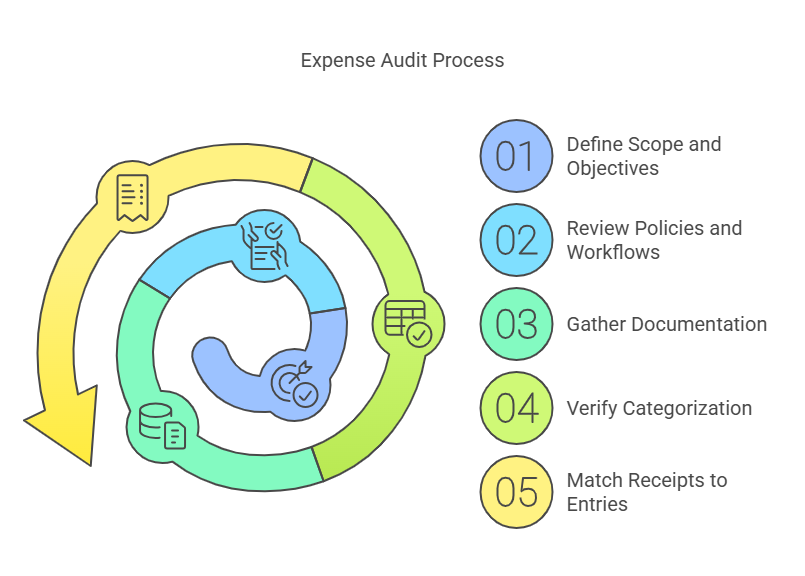

Audit Checklist

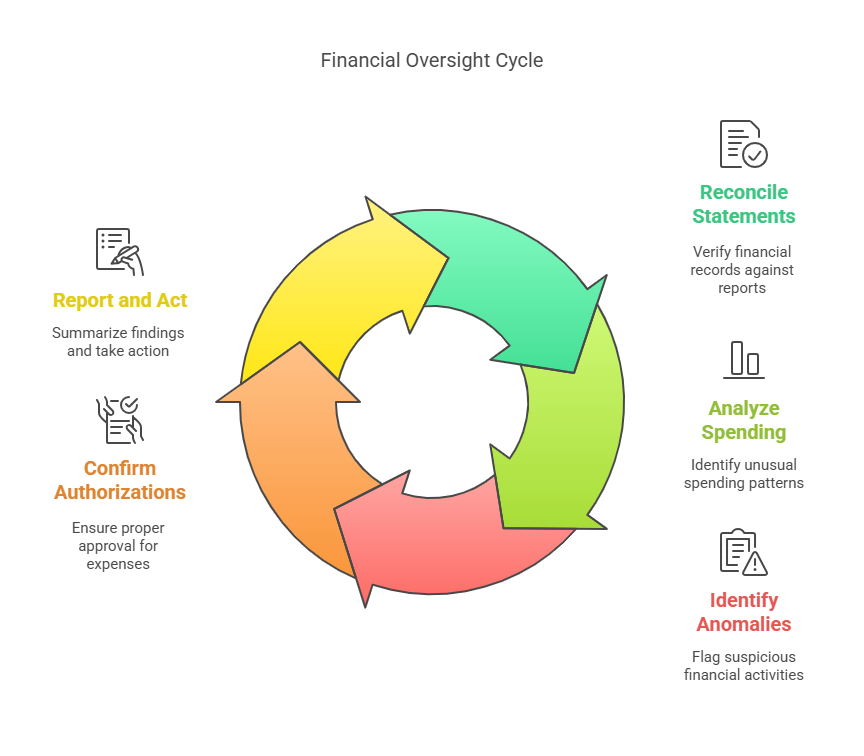

Follow these 10 actionable steps—the core of your 2025 expense‑control playbook:

- Define scope and objectives

Clarify which departments, periods, and expense types (e.g., travel, office supplies) you’ll review. - Review policies and workflows

Re‑read your expense policy. Who approves what, and how many sign‑off layers are required? - Gather documentation

Pull in every receipt, invoice, and credit‑card statement. These are your audit evidence—think “receipt matching” in action. - Verify categorization

Confirm each cost is booked to the right account in your chart of accounts: office supplies vs. software licenses. Match receipts to entries

Ensure dates, amounts, and vendor names on receipts line up exactly with accounting records.

Reconcile statements

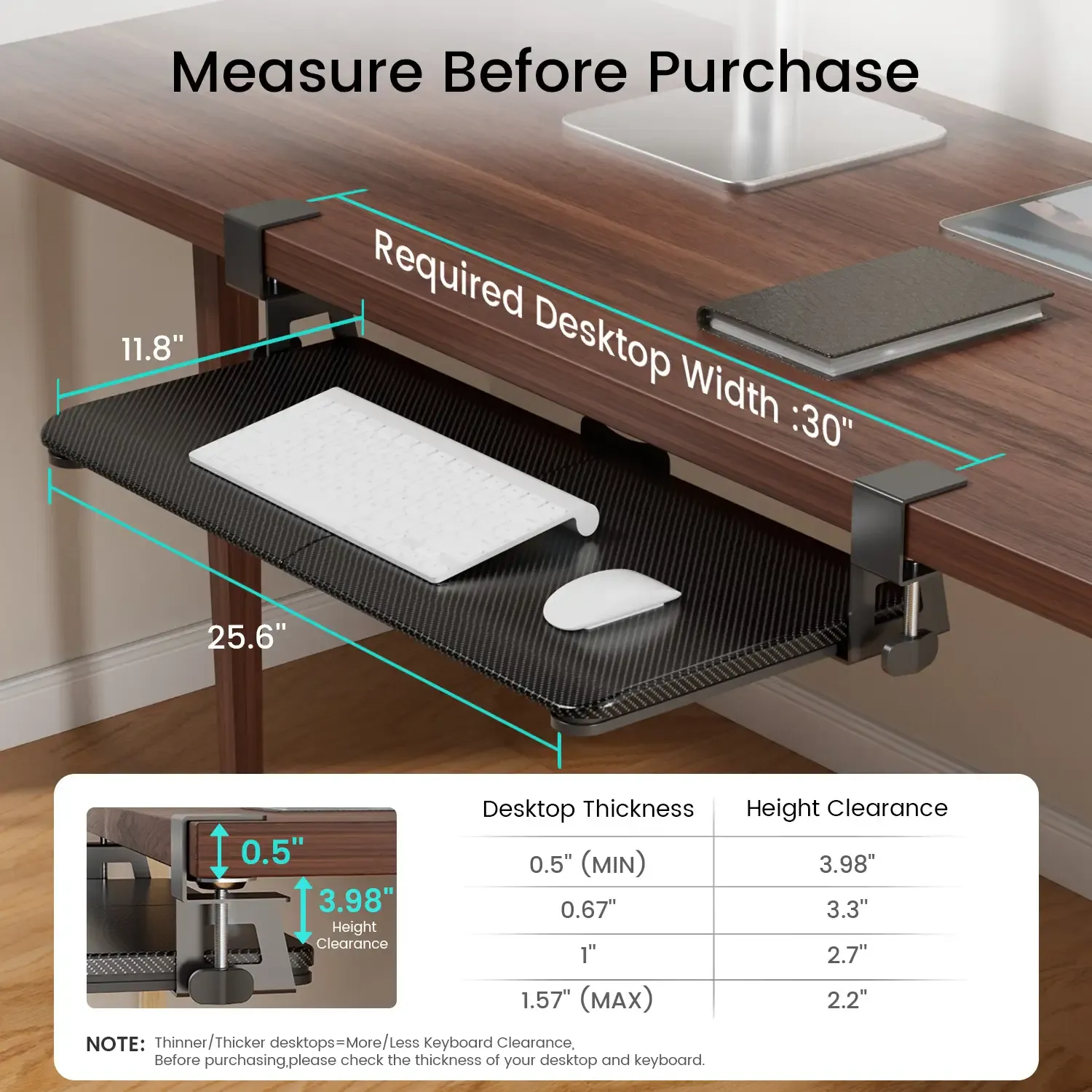

Cross‑check bank and credit‑card statements against submitted reports. For added comfort during long review sessions, consider a clip on keyboard tray to keep your wrists happy.

- Analyze spending patterns

Run trend and variance analyses to spot spikes in certain categories—like facility costs or travel—and question anything out of the ordinary. - Identify anomalies

Flag duplicate claims, out‑of‑policy charges, or missing approvals. These red flags often point to deeper control gaps. - Confirm authorizations

Double‑check that every expense has the correct digital or handwritten sign‑off—no unauthorized purchases. - Report and act

Summarize your findings, highlight risk areas, recommend corrective actions, and assign owners. Close the loop by following up in 30 days.

Bringing Ergonomics into the Audit Conversation

Smart ergonomic upgrades aren’t just a morale boost—they’re an investment with measurable ROI. Upgrading to the best ergonomic office chair for short people or offering office chairs for tall guys can reduce injury‑related costs and absenteeism, while an electric sit to stand desk supports healthier posture and sharper focus.

Conclusion

Embracing proactive expense auditing in 2025 means more than ticking checkboxes ✅ —it's about building a culture of:

Transparency 🔍

Efficiency ⚡

Smart cost control 💰

Automated tools 🤖 let you monitor 100% of transactions in real time, cutting errors and freeing your team to focus on strategic insights 🎯.

Regular spot-checks 📋 and quarterly reviews 📅 prevent small issues from becoming big problems.

Clear policies 📜, consistent training 🎓, and ergonomic upgrades (like proper office chairs for tall guys 🪑) boost both comfort and productivity.

Start your next audit now 🚀, and make 2025 the year you master expense control 💪.

FAQs

Q: How often should I audit office expenses?

I recommend monthly spot‑checks and quarterly comprehensive reviews to catch issues early and maintain budget health.

Q: Who should conduct the audit?

Internal finance teams know your systems best—combine them with occasional external reviews for fresh insights and added objectivity.

Q: What tools can help?

Look for AI‑driven expense‑management platforms, automated receipt‑capture apps, and ERP integrations—they speed up matching and flag anomalies instantly.

Q: How long does a typical audit take?

A lean, focused audit for a small team can wrap in one week; larger companies may need two to four weeks, depending on volume and complexity.

Q: What are common red flags?

Keep an eye out for duplicate claims, flat‑rate mileage abuses, unapproved vendor changes, and inflated reimbursements—these often indicate broken controls or attempted fraud.